In January of this year (2023) I did a little thought experiment: “how many games each year got at least 1000 reviews?”

The Steam algorithm is basically a giant filter. When a game launches Steam looks at early sales and if it likes what it sees, the algorithm determines that this game is worth promoting and starts to show it all over Steam. Basically this game becomes “blessed.” If you look at Steam enough, you start to see the same games in the “More Like This” section or in the “Recommended” section on the front page. This is basically how Steam curation works.

There isn’t anything magic in the algorithm about 1000, it was just a nice round number that is very hard to earn. From my experience working with clients we can do a really good marketing campaign, build a community, get them all excited and get them to buy and the game will earn about 200 reviews. However, if the game doesn’t excite them they won’t tell their friends, they won’t beg their favorite streamer to play it, and the Steam algorithm won’t wake up and start promoting it. Basically the Steam algorithm is responsible for taking the games it things have “it” and pushing them past 200 reviews and to 500 and then 1000 and beyond.

So last year I was curious, what are these “blessed” games? What genres? How many of them are there? I compiled my findings into a report and gave a presentation of it back in January. Here is a preview of it:

The talk and the report are only available if you purchased Game Marketing Ideas (you can watch it right now by clicking this link)

If you don’t have Game Marketing Ideas yet, I am running a HUGE discount for 75% off for 3 more days:

2022 update

One problem with my January 2023 review of the 2022 games was that games that were released at the end of 2022 didn’t have enough time to get up to my informal 1000 review filter. For instance, Vampire-Survivors-like Nordic Ashes launched on December 16th and only had 551 reviews by the time I did my January analysis. It now has over 2200 reviews. Steam is definitely promoting it now.

Therefore the 2022 numbers looked a lot worse than 2021. I couldn’t officially say “2022 was a worse year for indies” because there were still more games working their way through the pipe.

So now that we are halfway through 2023, I can make a more accurate assessment of how many steam games got to the 1000 review mark and I can now officially say “2022 was a worse year for indies.”

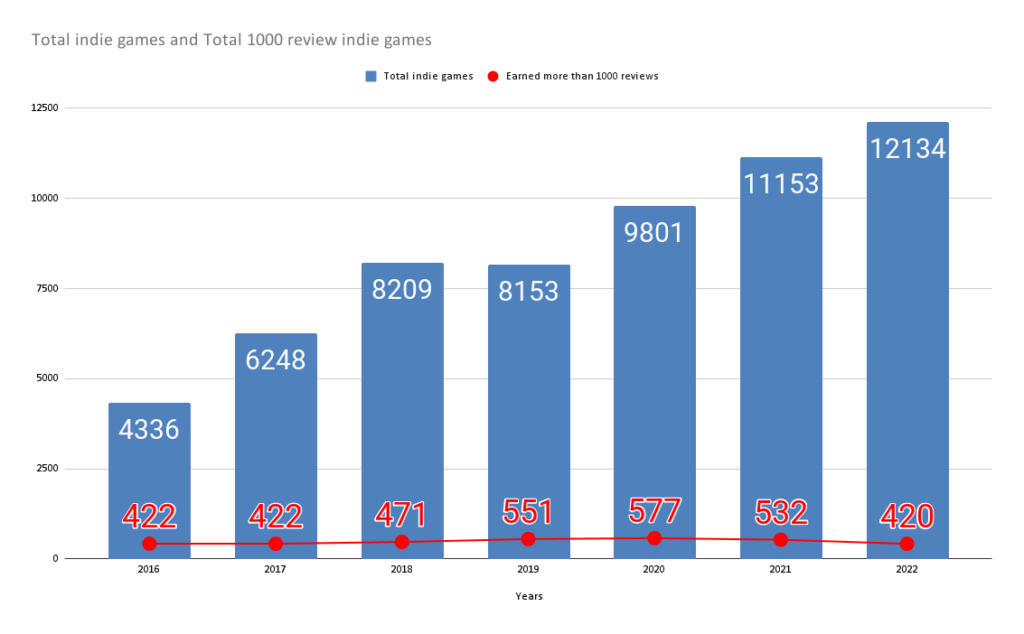

Here are the results of my revised 2022 survey

The blue bars are the total number of indie games released that year. The red line (and numbers) are how many of those games earned at least 1000 reviews. I used VGInsights to filter the games as indie and to get a review count. For more info on how VGInsights defines what an indie vs AA vs AAA studio is, see this article.

Unfortunately, as you can see, despite the increasing number of games on Steam, there are fewer games that are getting up to the vaulted “real steam” level. It isn’t even a smaller proportion of the total number of released games reaching top tier status, there are just flat out not as many games succeeding.

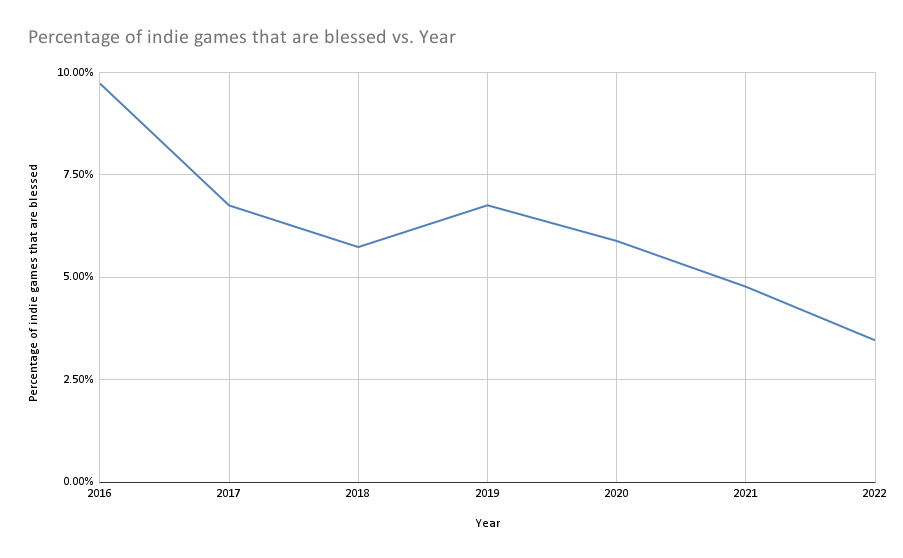

Here is the percentage of indie games that become “blessed” per year:

I am a pretty optimistic guy, but looking at the numbers, it doesn’t look very good for indie games on Steam. There are straight up fewer success stories. There are fewer games that are getting promoted by the algorithm. At this point I don’t know the cause. My hunch is that the algorithm has been shifting to show fewer games but the ones that it does like more often. It is becoming more winner take all. I am not sure exactly if those winners are making more, that will have to be a different survey I will do at some point.

What games were on the bubble?

So how many games didn’t make my original 1000+ review list but are now there? Were there any “hidden games” that were poorly reviewed and were discovered? Let’s find out.

- There were 76 new “blessed” games from 2022 (I will link to them down below in the Appendix)

- 23 of the games were released in the last quarter

- Only 3 were released in January of 2022 and took a full year and a half to reach the 1000+ review level.

Biggest net gain in reviews since my January survey (hidden gems)

- Unsolved Case (gained 2598 reviews)

- Melatonin (gained 2082 reviews)

- Nordic Ashes (gained 1697 reviews)

- Fear & Hunger 2: Termina (gained 1577 reviews)

- Bio Prototype (gained 1545 reviews)

I like looking at these “net gain” games because they indicate the chance for games to “turn it around” and become a best seller. I will examine some of these below.

The lowest starting point?

- Bio Prototype (413 reviews in January 2023)

- Shinobi Warfare (463 reviews in January 2023)

- Unsolved Case (475 reviews in January 2023)

- Expedition Agartha (480 reviews in January 2023)

- Scarlet Tower (535 reviews in January 2023)

I like looking at these “lowest starting point” numbers because we can see how low was the lowest game before it sprang back to 1000. Overall my opinion here is that hit games are hits. Steam knows real quick whether your game has the magic and is worth promoting. Bio Prototype for instance had 413 reviews in January. It gained that in 1 month. That is a lot! Overall, even the lowest low game did very well.

You can usually estimate the year 1 sales of your game by multiplying the week 1 sales by 5. There really aren’t any stories of a game launching with a flop at 10 reviews their first month and then slowly grinding their way up to 1000. Basically, it doesn’t take long to determine if your game will be a hit.

Unfortunately, a lot of studios come to me with the sad story of “We launched our game 3 months ago and our sales are weak, what can we do to turn it around?”

I am sorry to say, but 99% of games just don’t recover from that. The market, fans, Steam, all have given their verdict, they just aren’t interested. My best advice is to reflect on why the game didn’t connect and roll those findings into a second game that hopefully matches what the market wants.

Slow burn games

So what were the exceptions? Were there any games that started slow and then after a few months hit the magic 1000? Let’s take a look at a couple of them and see if we can figure out why

Unsolved case

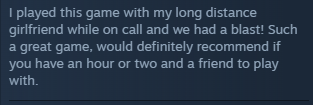

This co-op puzzle game is interesting. This year I found huge number of successful non-competitive, co-op games are very popular feature that could really differentiate your game against the competition.

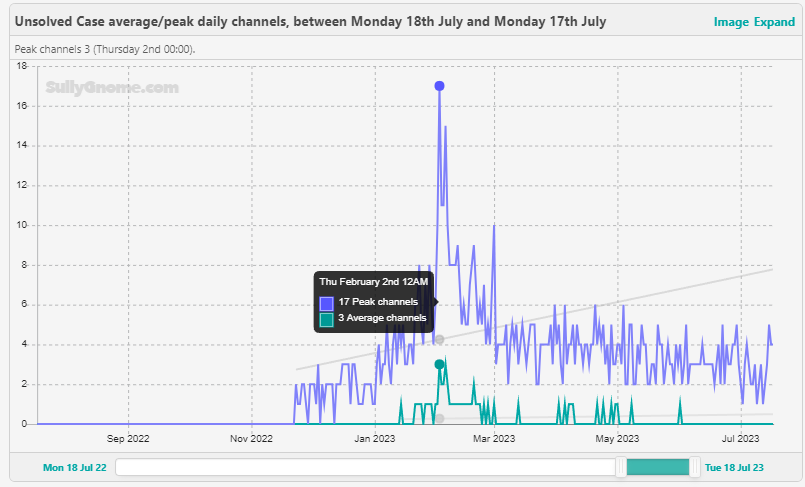

If you look at the review history you can definitely see that this game had a relatively slow burn. My bet is it was word of mouth slowly growing the player base. This makes sense for a co-op game.

You can see a parallel surge in concurrent player count:

Here is the Twitch streamer data for Unsolved Case. I am not sure if this is causation or correlation. 17 channels streaming the game simultaneously does not seem like it is enough to move numbers.

I love this review. One it is just wholesome, but two it just shows how people slowly introduce the game to each other.

But again this was not a turn around story. Unsolved case earned over 200 reviews within its first month. This wasn’t some game that had trouble getting its first 10 reviews.

Lunacid

Lunacid is an interesting case. Lunacid is a low poly adventure game that was inspired by a cult series named King’s Field that was developed by From Software in the PS1 and PS2 era. These games are kind of an evolutionary dead end before the Souls-like genre came out. Lunacid is fulfilling the needs of an underserved audience.

Lunacid started fairly strong and just barely missed my 2022 list because it only had 906 in January 2023. But Lunacid got a second wind in April of 2023 when Iron Pineapple found it. In his video he said that a lot of his fans recommended that he try it and so he did (see word of mouth).

Look at this review chart. You can definitely see the Iron Pineapple effect here.

Second side note: If you are making a souls-like or souls adjacent again, you need to be following, watching, and connecting with Iron Pineapple.

But again, similar to Unsolved Case, this was not a bomb that turned into a hit. As you can se Lunacid earned over 100 reviews at launch. It was a hit from day 1. It is just that there was a late-breaking second wind of support that came from Iron Pineapple. Steam makes its judgement on whether a game is worth promoting within the first few weeks, the question is whether your game will have any additional bursts of sales.

The enduring popularity of Vampire survivor likes

2022 was the year of the Vampire Survivors clones. The interesting thing was how broad based the genre was. Sure VS was the big winner but there was a class of similar games such as Brotato, 20 Minutes Till Dawn, and Soulstone Survivors.

There were a number of additional Vampire-Surivors likes that missed my original January cut.

Here is a list of additional games in the genre

- Nordic Ashes (Launched in December 2022 with 551 reviews but now has over 2000)

- Scarlet Tower (Launched in October 2022 with 535 reviews but now over 1000)

- Bio Prototype (Launched in December 2022 with 413 reviews but now has over 1500)

- Army of Ruin (Launched in October 2022 with 832 reviews and now has over 1300)

- Project Lazarus (Launched June 2022 with 912 reviews now has over 1100)

A NSFW test case. This is interesting test case, one company released 2 versions of from what I can tell is the exact same game (I did not play it, promise) but the only difference is one has adult content and the other one does not. The steam page and capsule is even 99% the same. So how much better did the lewd one do? The NSFW version has 100 more reviews. But anecdotally I have heard that NSFW games have a much much higher sale to review ratio because you have to be very confident in yourself to openly evaluate an adults only game.

- Sexy Mystic Survivors The NSFW version (you have been warned, the first screenshot makes it VERY clear) – launched in November with 791 reviews but now has over 1171)

- Beautiful Mystic Survivors The SFW version (964 reviews but now has over 1000)

Weird games

Although it is disheartening to see that the Steam store seems to have less capacity to promote indies, that does NOT mean that it is a race to higher and higher quality. There were lots of games that were just straight up non-commercial or employed non-traditional aesthetics. Here are some that I found.

Dialtown: Phone Dating Sim

Dialtown: Phone Dating Sim has a short description says “If you’ve ever wanted to romantically pursue a phone, then hot DARN, do I have just the game for you.”

Other interesting things is this game has been consistently popular. There was no one spike because one streamer found it. There is also a demo that appears to have been up from the start. So see, demos don’t necessarily hurt sales even for narrative games.

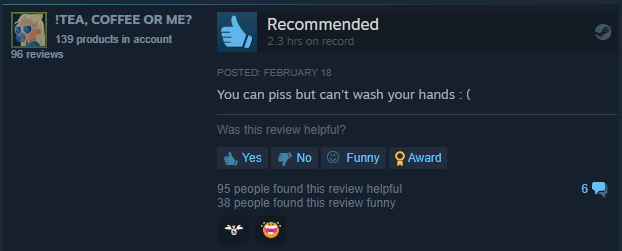

Fears to Fathom – Carson House

Digging deep into the top games of 2022 has proven to me the nearly insatiable desire by the Steam marketplace for horror games. Here is a great looking low-fi horror game

Here is a ringing endorsement of sorts:

Car Dealership Simulator

The reason I always tell indies to avoid 2D platformers is that the audience is relatively small and the genre is so competitive that to stand out you have to invest in an ungodly high level of production. Your game’s graphics have to be SO good and your gameplay mechanics have to be so novel that you basically reinventing the genre to stand out.

You are competing against games like Ori and the Will of the Wisps which looks like this:

Or, you can make games for genres where the audience is starved for fun experiences and you can have a hit that looks like this. No shade to the developers but, you know…

This is Car Dealership Simulator and you run a car dealership and I guess wear tracksuits. This game released into early access in September 2022 and missed my survey because it only had 900 reviews at the end of the year. But since its Early access 1.0 launch, it climbed to 1366 reviews.

Summary

What did we learn?

Lesson #1: So, things are definitely getting harder. There are more games coming in each year (it isn’t exponential growth, but it is still growing). The number of games that Steam is organically promoting seems to be going down which means the algorithm is smothering more and more indie games with less and less visibility.

Lesson #2: The success you see in your first month really determines how the rest of your game’s sales will go. In my games of 2022 reassessment survey, I didn’t see any games that had a rough launch and then magically became a hit. All the games that eventually reached 1000 all started with fairly strong launches and earned hundreds of reviews in their first month.

Lesson #3: Games can still be weird and look “handmade.” However, you need to be smart as to which genre you can do that in.

Lesson #4: Vampire-Survivor likes were still really popular even at the tail end of 2022.

Lesson #5: Horror games are still huge.

The end

Appendix:

The newly minted “blessed” games that were not in my original January 2023 survey.

Watch out, some of these are NSFW

- https://store.steampowered.com/app/1498040/Bio_Prototype/

- https://store.steampowered.com/app/1895300/Shinobi_Warfare/

- https://store.steampowered.com/app/2084050/Unsolved_Case/

- https://store.steampowered.com/app/1552620/Expedition_Agartha/

- https://store.steampowered.com/app/2181720/Scarlet_Tower/

- https://store.steampowered.com/app/2068280/Nordic_Ashes_Survivors_of_Ragnarok/

- https://store.steampowered.com/app/2171440/Fear__Hunger_2_Termina/

- https://store.steampowered.com/app/1881200/TRYP_FPV__The_Drone_Racer_Simulator/

- https://store.steampowered.com/app/1896700/Wylde_Flowers/

- https://store.steampowered.com/app/1927740/Monument_Valley_2_Panoramic_Edition/

- https://store.steampowered.com/app/2057080/Resonance_of_the_Ocean/

- https://store.steampowered.com/app/1981570/Land_of_the_Vikings/

- https://store.steampowered.com/app/2206340/Aokana__Four_Rhythms_Across_the_Blue__EXTRA2/

- https://store.steampowered.com/app/1706930/A_Taste_of_the_Past/

- https://store.steampowered.com/app/1999170/Insect_Swarm/

- https://store.steampowered.com/app/1449070/Journey_to_the_West/

- https://store.steampowered.com/app/581660/Super_Meat_Boy_Forever/

- https://store.steampowered.com/app/2176560/Dreamland/

- https://store.steampowered.com/app/2085360/Insomnia_Theater_in_the_Head/

- https://store.steampowered.com/app/2240530/BABBDI/

- https://store.steampowered.com/app/1964360/Sexy_Mystic_Survivors/

- https://store.steampowered.com/app/1850480/Cut/

- https://store.steampowered.com/app/1399720/Antimatter_Dimensions/

- https://store.steampowered.com/app/1697700/Whos_Lila/

- https://store.steampowered.com/app/1280930/Astral_Ascent/

- https://store.steampowered.com/app/1610900/The_Genesis_Project/

- https://store.steampowered.com/app/1918040/Army_of_Ruin/

- https://store.steampowered.com/app/2022180/Miss_Neko_3/

- https://store.steampowered.com/app/1350200/IMMORTALITY/

- https://store.steampowered.com/app/1442670/Hamster_Playground/

- https://store.steampowered.com/app/801550/VAIL_VR/

- https://store.steampowered.com/app/1580520/Lost_Eidolons/

- https://store.steampowered.com/app/2014780/XPlane_12/

- https://store.steampowered.com/app/1602080/Soulstice/

- https://store.steampowered.com/app/1411740/Urbek_City_Builder/

- https://store.steampowered.com/app/1904860/Legends_of_Kingdom_Rush/

- https://store.steampowered.com/app/1035990/Dialtown_Phone_Dating_Sim/

- https://store.steampowered.com/app/1182310/The_Excavation_of_Hobs_Barrow/

- https://store.steampowered.com/app/1592110/Spirit_of_the_Island/

- https://store.steampowered.com/app/1244800/Terraformers/

- https://store.steampowered.com/app/1896170/Prince_of_Suburbia__Part_1/

- https://store.steampowered.com/app/1298140/Fobia__St_Dinfna_Hotel/

- https://store.steampowered.com/app/1680550/Impact_Point/

- https://store.steampowered.com/app/1933650/The_Imperial_Gatekeeper/

- https://store.steampowered.com/app/1136380/Ultimate_Fishing_Simulator_2/

- https://store.steampowered.com/app/1585220/Melatonin/

- https://store.steampowered.com/app/1878740/Five_Nights_At_Floppa/

- https://store.steampowered.com/app/1745510/Lunacid/

- https://store.steampowered.com/app/1808060/Obama_Maze/

- https://store.steampowered.com/app/1389990/Oblivity__Find_your_perfect_Sensitivity/

- https://store.steampowered.com/app/2141690/Car_Dealership_Simulator/

- https://store.steampowered.com/app/2024230/Project_Lazarus/

- https://store.steampowered.com/app/1868000/Resist_the_succubusThe_end_of_the_female_Knight/

- https://store.steampowered.com/app/1811950/The_Legend_of_Heroes_Kuro_no_Kiseki/

- https://store.steampowered.com/app/1151050/Golf_Gang/

- https://store.steampowered.com/app/964440/Hell_is_Others/

- https://store.steampowered.com/app/1171320/Frog_Detective_3_Corruption_at_Cowboy_County/

- https://store.steampowered.com/app/2141730/Backrooms_Escape_Together/

- https://store.steampowered.com/app/1324340/Made_in_Abyss_Binary_Star_Falling_into_Darkness/

- https://store.steampowered.com/app/1190170/OlliOlli_World/

- https://store.steampowered.com/app/1059980/Just_King/

- https://store.steampowered.com/app/1482860/Idle_Research/

- https://store.steampowered.com/app/1827980/Idle_Spiral/

- https://store.steampowered.com/app/2138700/Crypt/

- https://store.steampowered.com/app/1629530/Spark_the_Electric_Jester_3/

- https://store.steampowered.com/app/1930640/Lost2/

- https://store.steampowered.com/app/1930600/Beautiful_Mystic_Survivors/

- https://store.steampowered.com/app/1497640/Traitors_in_Salem/

- https://store.steampowered.com/app/1599020/Tinykin/

- https://store.steampowered.com/app/1822910/Capybara_Spa/

- https://store.steampowered.com/app/2069640/Heros_Journey/

- https://store.steampowered.com/app/2120900/Fears_to_Fathom__Carson_House/

- https://store.steampowered.com/app/1256230/Hyperbolica/

- https://store.steampowered.com/app/1614550/Astro_Colony/

- https://store.steampowered.com/app/1846920/Lust_Academy__Season_1/

- https://store.steampowered.com/app/1986840/POPGOES_Arcade/