Every January I pull data from all the games that launched in the previous year to benchmark what happened to track trends and better understand what might happen in the next year. Well I am doing that again.

* Correction* 1/26/2023

IMPORTANT CORRECTION. I published this blog post on 1/25/2023 and missed the mark! I was talking to Simon Carless and he asked if I was counting Early Access games or 1.0 games in my data set and this lead me down a big rabbit hole that changed my ultimate perspective on how games did from 2022 to 2023.

What I got wrong. So last year when I pulled the 2022 number, the tool I used couldn’t distinguish between a Early Access games and 1.0s. I just got back a list of games that “launched” in some way in 2022. HOWEVER that 2022 dataset included games that had their EA in like 2015 and then had their 1.0 launch in 2022. That means they had been collecting reviews for several YEARS. This inflated the number of games to 416. In the past year my tool has improved greatly and I can specify to only show games that had their EA launch in 2022. What this did was make it look like 2023 was much worse in comparison to 2022. But the reverse was true. In 2023 there were more games that earned 1000+ reviews within the first year.

This changes my ultimate conclusion for the year. It also changes some of the graphs. In conclusion here is the correction

| Total number of games AA and Indie releases | Total games that got 1000+ reviews by the following January | |

| 2022 release | 12304 | 337 (2.73%) |

| 2023 release | 13834 | 354 (2.55%) |

SO I have rewritten portions of this blog. Anything that is rewritten is marked as *correction* and has italic text. I apologize for this oversight and I thank everyone who has double checked the data. I appreciate the oversight.

Recap

In my last blog I looked at the 14,000+ games released in 2023 and hoped to calm people’s fears, or at least inform them that the overwhelming growth was in games that earned 0-9 reviews. 10 reviews is the minimum bar that you must clear to get the tiniest bit of visibility from Valve. After looking at hundreds of games that released in 2023 that had fewer than 10 reviews, I can assure you that the vast majority of those games were first time developers just learning how to make games and market on Steam. Sub 10 games are not taking away visibility from professional game studios, or from teams that follow best practices when marketing. I am not saying it is easy to find success on Steam, but shaking your fist at the 14,000 other developers who have the same dream we all do is not the reason it is so hard.

This week, I am going to the other side of the chart; I am only looking at the big winners that secured 1000+ reviews. By looking at the big winners we can also see what IS resonating. It is possible to sell well on Steam (even as a solo or small developer.) In fact, some of them are part of the HTMAG community!

Why look at the 1000 reviews?

A game with 1000 reviews indicates that it is doing something right and that there is a hungry audience for it.

You cannot “game” your way to 1000 reviews with one weird trick or one hidden hashtag on Twitter or because you figured out that secretly the best time to post on Reddit is actually 11:39PM on a Tuesday. You can’t buy bots to get 1000 reviews. Going viral on TikTok isn’t sufficient to get 1000 reviews. There is no one influencer that can push a game up that high. A 1000+ reviewed game has to have something special about it.

But what about free games?

Even if the game is free it is hard to get to 1000! In 2023 there were 2,418 free games released on Steam and only 109 (or 4.5%) of them earned 1000 reviews.

1000 is a very high bar to reach and only the best of the best games make it this far.

In my experience, the only way to get a game to 1000 reviews is to have something special about your game. You also can’t buy your way there with ads. To get up THAT high, Steam has to notice it has the magic and apply its priceless featuring and promotion to it. And to get that featuring, Valve has to see good sales velocity or ongoing concurrent players after launch. If the algorithm sees good numbers, Steam quickly rewards the game with lots of views on the discovery queue, additional featuring in “More Like This,” better featuring during genre sales and festivals, and even the opportunity to opt into Daily Deals.

I explained it in depth in this lecture, but Steam visibility works like a ladder. Basically, with every visibility rung your game climbs, Steam gives you a bit more visibility, and if your game keeps performing well they show you in more places. Eventually with enough visibility you will get 1000 reviews.

IMPORTANT: Don’t fall into the old Goodhart’s law trap here on 1000 reviews. There is nothing magic to the number 1000. Don’t start emailing me and posting in the Discord “How Do I get 1000 reviews?!?” Steam doesn’t actually look at review count or review ratios to determine visibility. The algorithm only looks at wishlists and dollars earned. I just picked 1000 because it is a nice round number that is easy to calculate and sort by.

Speaking of sorting and filtering, for all the data I used VGInsights. This is not a paid endorsement. I pay for the service and like how clean the site is and how fast the data comes back.

Number of games that got in there

So as of January 2024, how many Indie / AA games that released in 2023 got 1000+ reviews?

415 games.

I then reviewed the list of 415 and removed some games that were only localized in Chinese or Russian (because that is a completely separate market that I can’t really draw many insights on from my position.) I also removed games that had famous IP such as Warhammer, or The Texas Chain Saw Massacre because you could argue that the IP did some of the heavy lifting of making the game popular. I only wanted to look at the games that were made by “small” companies that typical indies could learn from.

This filtering brought the number of 1000+ reviewed games down to 354.

13834 games released in 2023 and only 354 indie games claimed the big prize. That is only 2.5%.

That number will climb slightly as discounts get deeper and more people clear out their backlog and buy more of these 2023 games.

*corrected* Last January, I also looked at all games that earned 1000+ reviews, applied the same filtering of regional and IP games and found there were…

337 games.

So 2023 was actually a slightly better year so far. Last year 17 more games rose up the ranks of Steam than the previous year. It isn’t much more but the capacity for Steam to promote more games is increasing. Yes the total percentage of games that reach 1000+ is lower but I think that can be attributed to the huge growth in sub 10 review games (as discussed in the previous blog)

What are the top 5 genres

So of those 354 lucky 1000+ review games what is selling?

I went line by line to look at the Steam page of each of those 354 to try and determine what the games look like, what genre they are in, and what fans are saying. Relying just on tags can be deceptive because everyone uses the RPG tag and most Sim games apply the “Immersive Sim” tag incorrectly. Also for genre mashups, I tried to give my best assessment as to what the CORE genre is and what the secondary genre is.

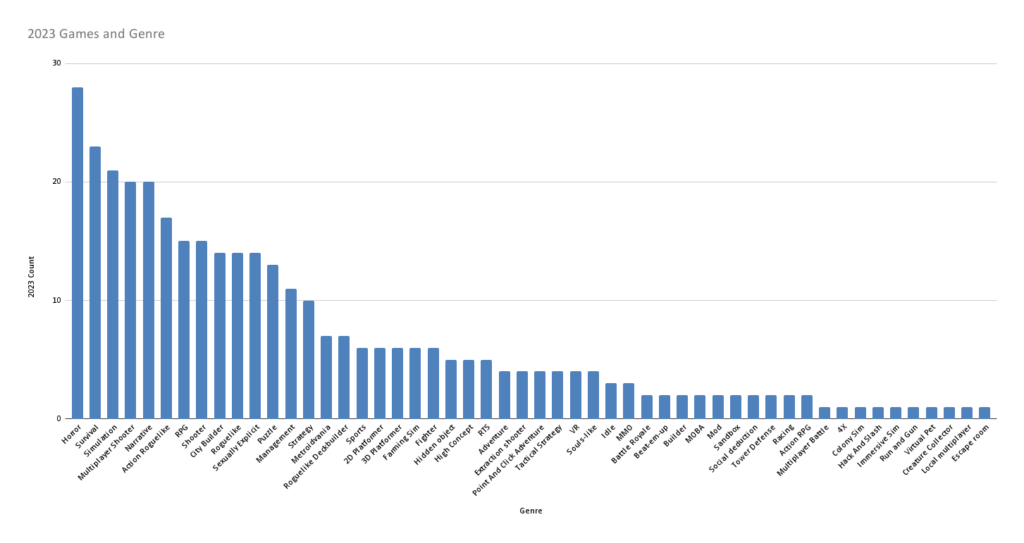

So based on my own (and I admit biased because we all are) assessment here are the genres that were most common among the top sellers:

So the top genres to reach success on Steam were

- Horror (28 games)

- Survival (23 games)

- Simulation (21 games)

- Multiplayer Shooter (20 games)

- Narrative (20 games)

Just like last year, Horror games are HUGE! People on Steam cannot get enough horror games. This is why I stand by my recommendation that at some point, every indie game developer should make at least 1 horror game.

Top examples were

- Lethal Company (co-op)

- The Outlast Trials (also co-op)

- Garten of Banban (solo)

The other big one is Survival. These games are typically called “Open World Survival Craft.” Basically they are games where you wash up in a foreign hostile land (or planet) with only the clothes (or spacesuit) on your back and must collect resources from the world to craft a base, vehicles, clothes, food, weapons, etc. Top examples were

Simulation is huge too and this is why I praise (with lots of other reservations) the company Playway. They realize how hot the market is and they keep a laser focus on producing more and more simulation games. Top examples of this genre are:

- Flashing lights

- Contraband Police (Playway)

- Car for Sale

But what about all the junk?

I know what you are thinking, Yes there were more Horror games in the top 1000 because so many crap horror games are released. So let’s look at the total number of games released in a few key genres and see what percentage of those games became hits.

One caveat here is that my 1000+ review list was hand classified. Doing a similar classification for all 14000+ games released in 2023 would take me a whole year to finish. So I am just going off self applied tags which isn’t always reliable.

| Genre | Earned 1000 reviews | Total released in 2023 | Percentage that reach the top |

| Roguelike Deckbuilder | 7 | 90 | 7.78% |

| Fighter | 6 | 80 | 7.50% |

| Multiplayer Shooter | 20 | 363 | 5.51% |

| Management | 11 | 224 | 4.91% |

| City Builder | 14 | 333 | 4.20% |

| Horror | 28 | 679 | 4.12% |

| Metroidvania | 7 | 226 | 3.10% |

| Simulation | 21 | 691 | 3.04% |

| Farming Sim | 6 | 201 | 2.99% |

| Survival | 23 | 1,179 | 1.95% |

| Action Roguelike | 17 | 941 | 1.81% |

| RPG | 15 | 879 | 1.71% |

| Roguelike | 14 | 1,096 | 1.28% |

| Sexually Explicit | 14 | 1,366 | 1.02% |

| Sports | 6 | 656 | 0.91% |

| Shooter | 15 | 1,818 | 0.83% |

| Narrative | 20 | 2,726 | 0.73% |

| 3D Platformer | 6 | 1,044 | 0.57% |

| Hidden object | 5 | 906 | 0.55% |

| Puzzle | 13 | 2,913 | 0.45% |

| 2D Platformer | 6 | 1,627 | 0.37% |

So there you go.

Roguelike Deckbuilder has one of the best chances of finding an audience.

But… I wouldn’t make big studio decisions based on this chart. I did this chart because people always ask “well what about the total?”

The problem is developers tag their games incorrectly all the time and some genres don’t fit neatly into the tags. The Strategy genre is easy to identify when you see it, but almost every game applies the “Strategy” tag because they want to prove that they are “Deep.” So, determining the genre off the tags is very hard (that is why I visually inspect the genres of the top 500 games).

And to be honest, although 14,000 games sounds like a lot, when you start dividing the games down by genres, the sample size isn’t that large. Ironically there aren’t enough games released every year to have a good sample size.

Are these genres dead?

Anytime I write about hit genres I always get the comment “ya but by the time I finish making that game will it still be popular?”

In general, I believe genres shift a lot slower than people think they do.

Vampire Survivor likes (Action roguelikes)

In January 2021 Vampire Survivors EA launched and was an instant hit and I wrote that making Vampire-Survivor-likes might be a good idea. A lot of other developers thought the same thing and in 2022 the huge wave of them hit Steam.

In 2022 there were 10 Vampire-survivor-likes that earned over 1000 reviews out of 623 total games released (2%). (*corrected* previously said 13 because 3 EAed pre 2022)

In 2023 there were 17 of them that earned over 1000 reviews out of 941 total games released (1.8%).

Looking at the 17 that were released this year I can see that the quality bar is rising and competition is harder, but fans really do like playing them. Fans are not tired of Vampire Survivors yet.

Roguelike deckbuilder

I always find the discourse on this genre so strange. People in youtube comments are always saying something like “Ugh, is this genre still a thing? Everyone is making them now, and it is a done genre”

In 2022 only 51 games were tagged as “Roguelike Deck Builder” and 5 of them reached 1000 reviews (15.6%) (*corrected* previously said 8 because 3 EAed pre 2022)

In 2023 there were still only 90 released and 7 of them reached 1000 reviews (7.78%).

Yes the number released nearly doubled but that pales in comparison to genres like 2D platformers (1,627 released in 2023).

I think so many people have the “Roguelike-Deckbuilder-is-over-saturated” mentality because the genre is still under a decade old so it feels like everyone is still trying to ride the “Slay The Spire” hype train. It is like when people used to call FPSs “Doom Clones.” There is a lot of room for innovation in the deckbuilder genre and fans still are interested in them and there aren’t a lot of them being made (it is the second-highest by percentage chance at success). Relax.

The Steam Store is clogged with p0rn games

Complaining about too much Adult content is almost as popular as complaining that there are too many games. But if you look at the numbers, it isn’t changing very much and the proportion that are successful is dropping ever so slightly.

In 2022 there were 1,308 tagged with “Sexual Content” and 20 reached 1000 reviews (1.5%) (*NO CORRECTION HERE* p0rn games don’t typically go into early access so there was no extra count.)

In 2023 there were 1,366 such games and 14 reached 1000 reviews (1.0%)

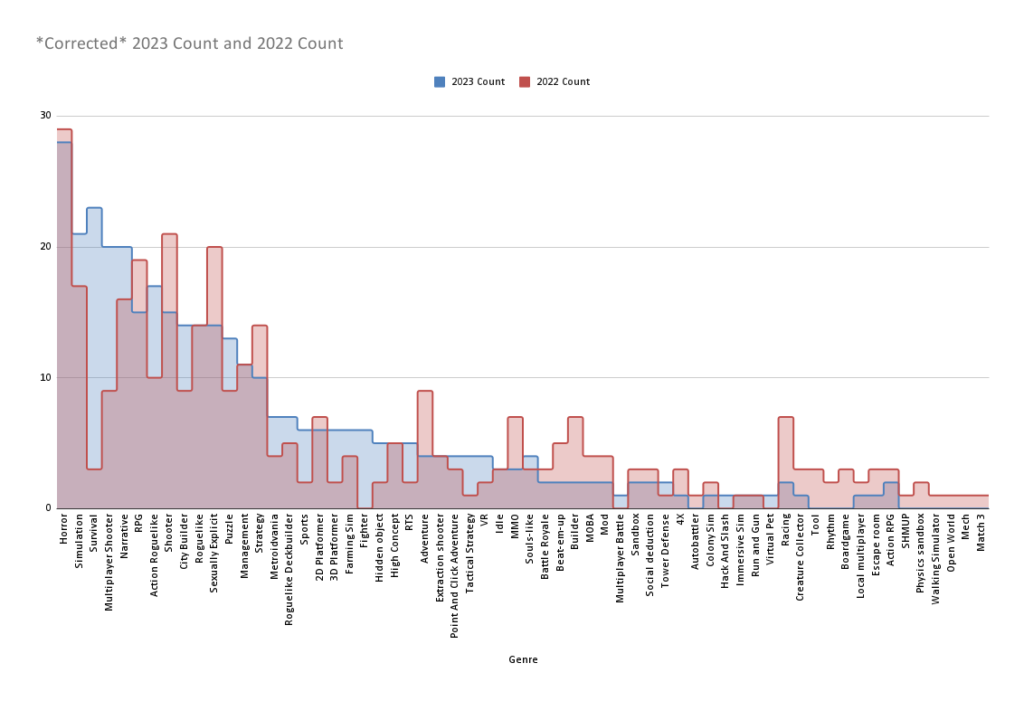

So how do the years compare genre wise?

Here is a full chart of all the games that reached 1000+ reviews in January of 2022 and 2023.

*corrected* Chart was corrected but the observations still stand about which genres were more popular than in 2022.

Observations about the big changes in 2023

- There were more Survival, more Action Roguelikes (Vampire Survivor Likes), Fighters, RTS, and Tactical Strategy. Even VR did a bit better.

- 2D Platformers did worse, but 3D platformers did better.

- There was less variety at the low end.

- Multiplayer (especially coop) was much more popular

So was 2023 a worse year?

*Correction* note this entire section was rewritten with the new data that there were 17 fewer games in the 1000+ range in 2022

The hard thing trying to determine whether the 2022 or 2023 was a better year for indies is to determine where the line is. What is “the line?” The algorithm and curation of Steam is always about promoting the games it thinks are “good” and smothering the ones it thinks aren’t worth it. What I am trying to figure out is did “the line” move to allow more developers into the inner circle of games that can earn a sustaining income and did it increase the amount of money those games earn?

I wanted to try something simple. If I look at just the Indie and AA games from 2022 and 2023 at the same relative period of time and just sum the TOTAL number of reviews those 1000+ games got, what is the result?

2022 – 1,799,440 total reviews (or 5339 per game)

2023 – 2,721,029 total reviews (or 7686 per game)

921,589 more reviews were left for indie games at the top tier in 2023. That means those games “above the line” are getting purchased and played more than in 2022.

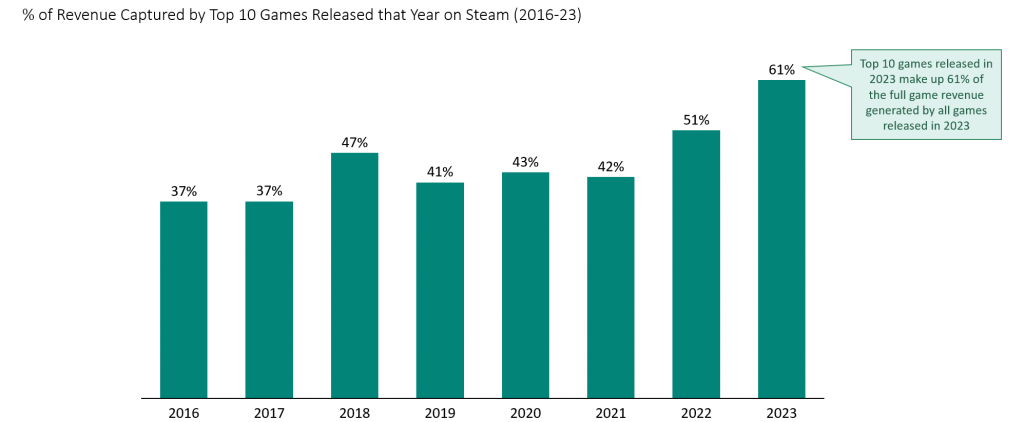

And you can see something similar looking at the estimated revenue. In the 2024 report from VGI Insights, they estimate that the top 10 games on Steam earned 61% of the total revenue. This is a dramatic increase from 2022.

Those top 10 games that made 61% of revenue are (in order of earnings)

- Baldur’s Gate 3

- Hogwarts Legacy

- Starfield

- Resident Evil 4

- Sons Of The Forest (Indie)

- EA SPORTS FC™ 24

- ARMORED CORE™ VI FIRES OF RUBICON™

- Lethal Company (Indie)

- STAR WARS Jedi: Survivor™

- Cities: Skylines II (AA)

From one perspective, it is amazing that 2 indie games and one from a AA size company can outcompete a AAA game. That is what is amazing about Steam and why I still think it is an amazing service that we should still make games for. Steam is definitely pushing the games “above the line” harder and getting them more money.

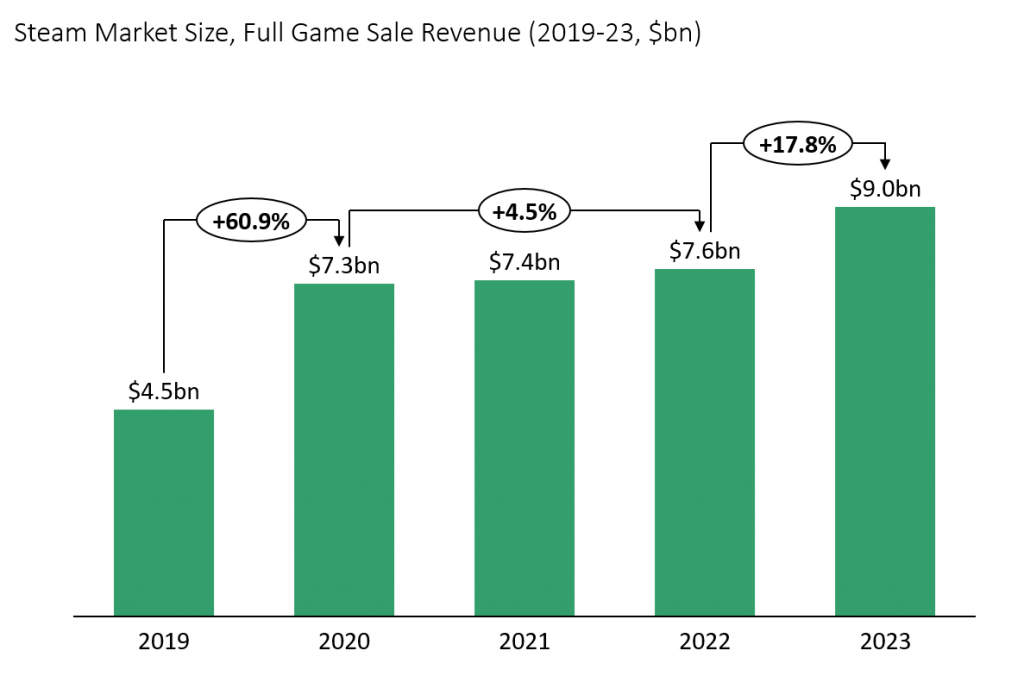

On the other hand, Steam has become more and more winner take all. That VGInsights post also had this amazing estimation that Valve increased revenue from Steam by nearly 18 percent. Prioritizing the hits is working for them and players are happier than ever. Steam passed an all-time concurrent user record.

So yes the top is earning more and there are definitely more indies at the top. Which is good.

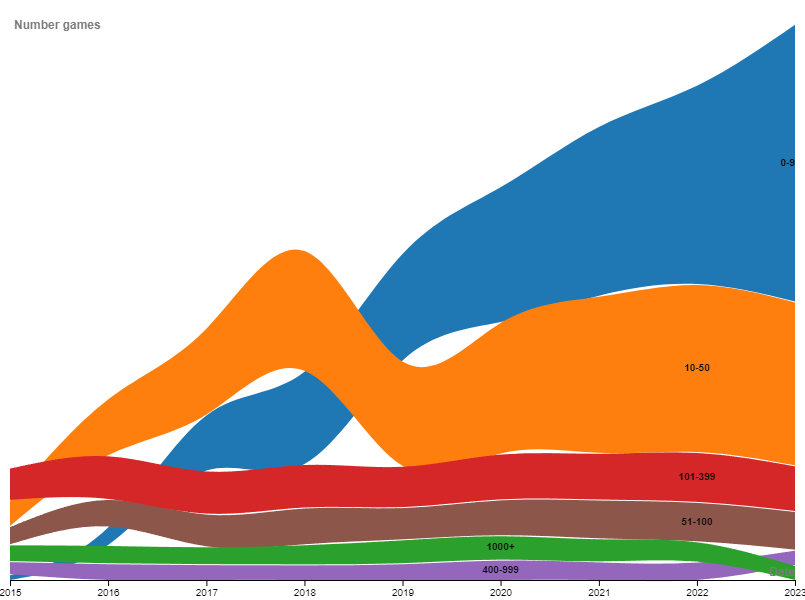

But I also know that the lowest tier of games that earn fewer than 10 reviews is bigger and not earning much. I made this chart for my last blog and you can see the dramatic increase of the blue zone. I think if you make a decent, non buggy game, in a decent genre, and do some of the minimum work required to promote your game (steam next fest, promote to streamers, enter festivals) you will not be in the sub 10 range. But how much further can you rise?

After this blog post I still don’t know where “the line” moved. Which tier of developers had it easier this year and which tier had it harder? I don’t have an answer for this yet. But ultimately, I don’t think the problem is that there are too many games. The problem is that the island is shrinking; there are fewer games that are making more money and everyone else is sliding back into the ocean.

It rubs me the wrong way to see a bunch of developers yelling at other developers about too many games when the real problem is the floor is dropping out around the edges.